Skincare sits at the heart of the beauty economy. How big is the skincare industry in 2026? The global beauty market generated about $446 billion in retail sales in 2023, and skincare products provided roughly 44% of that revenue. Analysts expect the skincare industry to grow from around $162 billion in 2025 to more than $222 billion by 2030, a compound annual growth rate of roughly 6.5%. While Asia Pacific is the fastest‑expanding region, the United States remains the largest national market and exerts an outsized influence on global trends. This report condenses the most recent skincare industry statistics to provide a snapshot of the U.S. skincare market in 2026.

U.S. Skincare Market Size and Growth Statistics

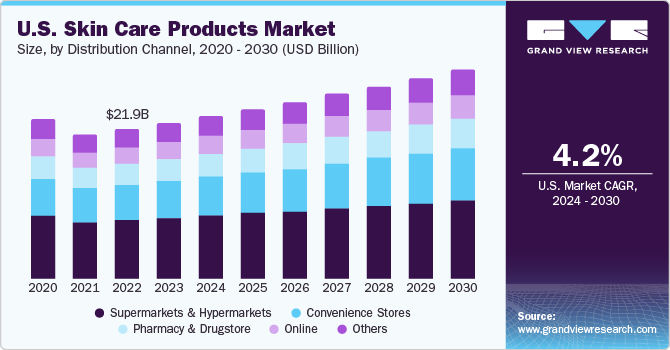

Industry reports gauge revenue from the U.S. skincare industry to be in the low twenty‑billion‑dollar range. Grand View Research estimates that U.S. sales were about $22.90 billion in 2023 and forecasts annual growth of about 4.2% through 2030.

Archive Market Research reports a similar baseline of $23.85 billion in 2023 and projects revenue will approach $32 billion by 2032. Applying these growth rates yields an estimated market size of about $24 billion in 2025, making skincare larger than many household goods categories. Despite representing just a fraction of the world’s population, the United States accounts for about 16% of global skincare spending, according to Grand View Research. The broader North American beauty sector grew 9% year over year in 2023 as consumers traded up to premium products. Stable demand and steady price increases suggest a market that is resilient even amid economic headwinds.

Global Skincare Industry Statistics

The United States competes within a fast‑growing global market. Mordor Intelligence values the worldwide skincare industry at $162.11 billion in 2025 and expects it to reach $222.07 billion by 2030. Asia Pacific leads growth, controlling 37.76% of revenue in 2024 and expanding at 7.64% per year.

North America’s growth is more moderate—around 6% annually—yet the region still delivers about 20% of overall beauty sales. Global skincare industry data underscore two realities: America remains a crucial market, but innovations often originate from East Asian companies and quickly become global best‑sellers. U.S. brands, therefore, compete by emphasizing dermatologist‑backed science, clean ingredients, and inclusive marketing.

Category and Channel Segmentation

Sales are concentrated in a handful of categories. A 2023 analysis shows that face creams and moisturizers generate about 42% of skincare industry revenue, while sun‑care products form the next largest segment. Male grooming products are growing quickly, but women still purchase most skincare items, and mass‑market moisturizers remain the cornerstone of routines. Supermarkets and hypermarkets capture the largest share of skincare sales, yet the fastest growth is online, where e‑commerce and subscription services make it easy to discover niche brands. While women dominate, the men’s segment now generates tens of billions of dollars, and gender‑neutral lines are broadening the customer base.

Who Buys Skincare Products?

Most Americans use some form of skincare. A 2025 survey of U.S. adults found that 89% purchase products and 46% follow a daily routine. Usage is particularly high among women, affluent households, and certain ethnic groups, but enthusiasm spans generations. Gen Z respondents were the most active buyers, with 58% purchasing a product in the prior month, reflecting the influence of social media and early adoption of preventative care.

Spending and time commitments reflect the category’s importance. Americans allocate about $492 per year to skincare, with women spending more than men. They devote roughly 30 minutes a day to grooming. Yet basic habits are inconsistent: a CeraVe survey cited by NewBeauty found that 60% of men do not wash their faces, and over half use hand soap when they do, and almost half of women skip nighttime cleansing. These gaps highlight opportunities for education.

Trends Driving Growth in 2025

Modern consumers demand more from their routines. Natural and sustainable formulations are mainstream: over half of Americans look for eco‑friendly labels and natural ingredients. Digital influence also shapes purchasing: roughly a third of shoppers consult influencers and social media for recommendations, and many join loyalty programs or shop directly through apps. While consumers value science‑backed products, most still rely on peer reviews more than professional advice.

Personalization and demographic expansion will define the next era. Brands use quizzes and algorithms to tailor routines, while devices such as LED masks and micro‑current tools allow spa‑like treatments at home. The customer base is diversifying: men are embracing multi‑step regimens, and the U.S. men’s skincare products market already measures in the tens of billions. Older adults seek anti‑aging solutions, while younger generations prioritize prevention.

Skincare Industry Retail & Distribution Trends

Where consumers shop is evolving. Supermarkets and hypermarkets still capture the largest share of skincare sales, reflecting the convenience of one‑stop shopping and competitive pricing. Yet the fastest‑growing channel is online: Mordor Intelligence projects that e‑commerce will expand nearly 8% annually through 2030. Direct‑to‑consumer brands, subscription boxes, and buy‑online‑pick‑up‑in‑store models make it easier for consumers to try niche products and curate routines. Loyalty programs and social shopping features encourage repeat purchases and brand advocacy. Retailers that blend physical and digital experiences are best positioned to meet shoppers where they are.

Conclusion and Implications for the Future of Skincare

The evidence points to a robust yet evolving marketplace. By 2025, the U.S. skincare industry will generate about $24 billion in annual revenue, growing roughly 4–5% per year. Globally, skincare remains the largest beauty category and is expected to exceed $222 billion by 2030. Asia Pacific leads growth, but the United States still commands the largest national market thanks to high consumer spending and a culture that values premium solutions. Key trends—demand for natural ingredients, digital and social shopping, personalization technologies, and a surge in men’s participation—are reshaping product development and distribution. The shift toward e‑commerce and omnichannel shopping complements, rather than replaces, the dominance of brick‑and‑mortar retailers.

For students, entrepreneurs, and aspiring professionals, these dynamics offer considerable opportunity. A thorough understanding of skin biology, product ingredients, and client consultation will be vital. Tricoci University of Beauty Culture provides comprehensive esthetics and cosmetology programs to prepare students for the future. By mastering both science and artistry, graduates can help consumers achieve healthy, glowing skin while meeting growing expectations for efficacy, sustainability, and personalization.

Esthetician School Campuses

- Indianapolis Esthetician School

- Highland Esthetician School

- Normal Esthetician School

- Peoria Esthetician School

- Bloomington Esthetician School

- Rockford Esthetician School

- Janesville Esthetician School

- Lafayette Esthetician School

- Elgin Esthetician School

- Urbana Esthetician School

- Libertyville Esthetician School

Cosmetology School Campuses

- Indianapolis Cosmetology School

- Bloomington Cosmetology School

- Urbana Cosmetology School

- Janesville Cosmetology School

- Elgin Cosmetology School

- Lafayette Cosmetology School

- Highland Cosmetology School

- Libertyville Cosmetology School

- Peoria Cosmetology School

- Normal Cosmetology School

- Rockford Cosmetology School

Sources:

The beauty industry boom: Can growth be maintained? | McKinsey

https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/the-beauty-boom-and-beyond-can-the-industry-maintain-its-growth

Skin Care Products Market – Size, Analysis, Growth & Trends

https://www.mordorintelligence.com/industry-reports/skincare-products-market

U.S. Skin Care Products Market Size & Share | Report, 2030

https://www.grandviewresearch.com/industry-analysis/us-skin-care-products-market-report

U.S. Skin Care Products Market Unlocking Growth Opportunities: Analysis and Forecast 2025-2033

https://www.archivemarketresearch.com/reports/us-skin-care-products-market-148

Skin Care Products Market Poised for Significant Growth:

https://www.openpr.com/news/3676374/skin-care-products-market-poised-for-significant-growth

Skincare Statistics and Facts (2025)

https://media.market.us/skincare-statistics/

Provoke-Insights_Summer2025_Skincare.pdf

https://provokeinsights.com/wp-content/uploads/2025/03/Provoke-Insights_Summer2025_Skincare.pdf

America’s Beauty Budgets Data Study 2024

https://www.advdermatology.com/blog/americas-beauty-budgets/

You Won’t Believe How Many Americans Don’t Wash Their Faces

https://www.newbeauty.com/you-wont-believe-how-many-americans-dont-wash-their-faces/